- O nama

- Oblasti djelovanja

- Usluge

- Događaji

- Resursi

- Uključi se

- O nama

- Oblasti djelovanja

- Usluge

- Događaji

- Resursi

- Uključi se

Ostalo je još samo nekoliko dana za prijave na obuku za omladinske političke lidere (UMiDp)!

Znate li da je ostalo još samo nekoliko dana za prijave na obuku za omladinske političke lidere (UMiDp)? Institut za razvoj mladih...

ByInstitut za razvoj mladih KULT23.04.2024Otvoreni pozivi za prijave: Aktivni građani – snaga lokalne zajednice! MOSTAR I GRADIŠKA

Želite li biti glas svoje zajednice? Da li vas zanima kako se...

ByInstitut za razvoj mladih KULT23.04.2024Kafa s… Ivanom Soldo: Isplatiće se sve što radite s ljubavlju

Ivana Soldo, učesnica posljednje sezone MasterChef Hrvatska, ostavila je snažan dojam svojim...

ByInstitut za razvoj mladih KULT20.04.2024Posjete koje šire vidike i uče kako iskoristiti pružene prilike

Institut za razvoj mladih KULT danas je ugostio predstavnika Centra za edukaciju...

ByInstitut za razvoj mladih KULT17.04.2024Učesnici UMiD obuka spremni su za nove liderske poduhvate!

Institut za razvoj mladih KULT je održao ceremoniju dodjele certifikata i potvrda...

ByInstitut za razvoj mladih KULT16.04.2024Sadašnjost i budućnost: Lokalni napredak uz snažne organizacije civilnog društva

Institut za razvoj mladih KULT organizira konferenciju Sadašnjost i budućnost: Lokalni napredak...

ByInstitut za razvoj mladih KULT15.04.2024Pridružite nam se na Kafi sa Ivanom Soldo!

Institut za razvoj mladih KULT organizira “Kafu sa Ivanom Soldo”! Ivanino ostvarenje...

ByInstitut za razvoj mladih KULT09.04.2024#RAD S MLADIMA

Ostalo je još samo nekoliko dana za prijave na obuku za omladinske političke lidere (UMiDp)!

Znate li da je ostalo još samo nekoliko dana za prijave na obuku za omladinske političke lidere (UMiDp)? Institut za razvoj mladih KULT...

ByInstitut za razvoj mladih KULT23.04.2024Kafa s… Ivanom Soldo: Isplatiće se sve što radite s ljubavlju

Ivana Soldo, učesnica posljednje sezone MasterChef Hrvatska, ostavila je snažan dojam svojim kulinarskim vještinama tokom takmičenja, ali i sinoć na Kafi s…, koju...

ByInstitut za razvoj mladih KULT20.04.2024Učesnici UMiD obuka spremni su za nove liderske poduhvate!

Institut za razvoj mladih KULT je održao ceremoniju dodjele certifikata i potvrda učesnicima Uči, Misli i Djeluj 18 obuke (UMiD 18) i učesnicima...

ByInstitut za razvoj mladih KULT16.04.2024Pridružite nam se na Kafi sa Ivanom Soldo!

Institut za razvoj mladih KULT organizira “Kafu sa Ivanom Soldo”! Ivanino ostvarenje sna u proteklom periodu mogli smo pratiti na televiziji. Veliki je...

ByInstitut za razvoj mladih KULT09.04.2024Javni poziv za učešće u obuci: Uči, Misli i Djeluj! obuka za nastavno i stručno osoblje srednjih škola

O INSTITUTU Institut za razvoj mladih KULT (u daljem tekstu: Institut) jedna je od vodećih nevladinih organizacija u Bosni i Hercegovini koja preko...

ByInstitut za razvoj mladih KULT05.04.2024Javni poziv za obuku Uči, misli i djeluj! za omladinske političke lidere

Institut za razvoj mladih KULT (u daljem tekstu: Institut) raspisuje Javni poziv za učešće na obuci za omladinske političke lidere, UMiD za omladinske...

ByInstitut za razvoj mladih KULT04.04.2024Produžene su prijave za Obuku za stručne saradnike za rad s mladima!

Zbog velikog broja upita i interesovanja za Obuku za stručne saradnike za rad s mladima, Institut za razvoj mladih KULT je produžio rok...

ByInstitut za razvoj mladih KULT01.04.2024Ostala su još samo dva dana za prijave na Obuku za stručne saradnike za rad s mladima

Ostala su još samo dva dana za prijave na Obuku za stručne saradnike za rad s mladima! KO SU STRUČNI SARADNICI ZA RAD...

ByInstitut za razvoj mladih KULT30.03.2024#ORANGE DAY

Srednjoškolci iz BiH doprinijeli borbi protiv nasilja nad ženama i djevojčicama

Institut za razvoj mladih KULT ovog mjeseca sarađivao je sa JU Opća gimnazija “Bosanska Krupa” i JU Prva bošnjačka gimnazija kako bi zajedno...

ByInstitut za razvoj mladih KULT29.03.2024Kroz narandžasti objektiv: Godišnji izvještaj za 2023. godinu

Nasilje nad ženama i djevojčicama predstavlja grubi oblik kršenja osnovnih ljudskih prava i diskriminacije, te je rasprostranjen društveni problem u svim državama svijeta,...

ByInstitut za razvoj mladih KULT28.02.2024Pet žena iz BiH: Korak po korak do rodne ravnopravnosti

U Bosni i Hercegovini, kao i u ostatku svijeta, svakog 25. u mjesecu obilježava se Narandžasti dan, kao datum podizanja svijesti i sprečavanja...

ByInstitut za razvoj mladih KULT05.02.2024Strateški pristup u radu s mladima u FBiH – za intenzivnije uključivanje mladih u procese odlučivanja

Intenzivnim angažmanom Interresorne radne grupe za izradu strategije za mlade Federacije BiH do 2027. godine, uz podršku Instituta za razvoj mladih KULT,...

ByInstitut za razvoj mladih KULT04.04.2024Institucionalna briga o mladima je prioritet još jedne lokalne samouprave u Unsko-sanskom kantonu: Grad Cazin kreira strategiju prema mladima

Istraživanje o položaju i potrebama mladih grada Cazina je radio Institut za razvoj mladih KULT u partnerstvu sa Vijećem mladih Grada Cazina,...

ByInstitut za razvoj mladih KULT07.02.2024Kako približiti BiH Evropskoj uniji? Mladi znaju!

Događaj Inicijative mladih za EU integracije održan u okviru projekta “Inkubator zagovaračkih inicijativa mladih” istakao je angažman mladih i njihove zagovaračke inicijative...

ByInstitut za razvoj mladih KULT26.01.2024#DOGAĐAJI

august, 2023

#EKONOMSKI RAZVOJ

Šta otvaranje pristupnih pregovora EU s BiH znači za civilno društvo i mlade u BiH?

Evropsko vijeće jučer je donijelo odluku kojim Evropska unija otvara pregovore o pristupanju s Bosnom i Hercegovinom. Ovom odlukom Evropsko vijeće poziva...

ByInstitut za razvoj mladih KULT22.03.2024Mladi iz Švedske dvosedmičnu studijsku posjetu BiH završili preplavljeni pozitivnim utiscima

Da mobilnost mladih u svrhu učenja i razumijevanja različitih tema u praksi...

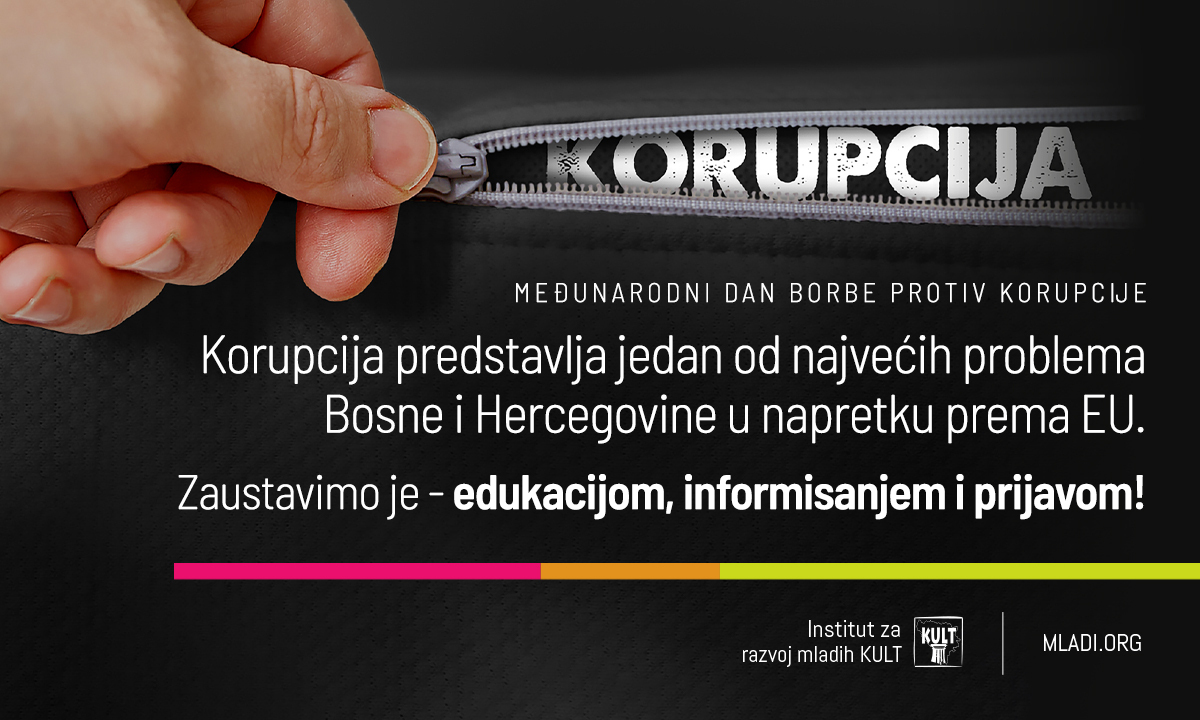

ByInstitut za razvoj mladih KULT08.02.2024Izazovi i prepreke u Bosni i Hercegovini na putu prema društvu bez korupcije

Međunarodni dan borbe protiv korupcije obilježava se od 2003. godine kada je...

ByInstitut za razvoj mladih KULT09.12.2023Društveno-korisna upotreba oduzete imovine: naučene lekcije i izazovi

Institut za razvoj mladih KULT je sudjelovao u ključnim aktivnostima unutar OSCE...

ByInstitut za razvoj mladih KULT29.11.2023Koliko nas i kako košta korupcija u BiH?

Rezultati Istraživanja o položaju mladih u BiH Instituta za razvoj mladih KULT...

ByInstitut za razvoj mladih KULT16.08.2023Poziv na događaj: „Kafa sa Janom Waltmansom“

Institut za razvoj mladih KULT sa zadovoljstvom najavljuje i predstavlja našeg novog...

ByEmir Pašanović27.06.2023Progovoriti o temama koje su veliki problem u društvu je korak ka promjeni!

Srednjoškolci i članovi lokalnog tima Asocijacije srednjoškolaca u BiH prisustvovali su novoj...

ByInstitut za razvoj mladih KULT16.06.2023Šta su izazovi i problemi mladih u Modriči?

O izazovima sa kojima se susreću mladi u Modriči govori istraživanje koje je Institut za razvoj mladih KULT proveo u saradnji sa...

ByInstitut za razvoj mladih KULT11.03.2024